Stay one step ahead in the competitive world of Italian commerce as we unveil the indispensable guide to navigating legal and regulatory obligations in Italy.

Italy, renowned for its stunning landscapes and iconic landmarks, also boasts a dynamic business environment that entices entrepreneurs worldwide. From family-owned trattorias to multinational corporations, businesses in Italy find themselves under the scrutiny of an intricate legal framework. Understanding and adhering to these requirements is essential for safeguarding stakeholders’ interests and upholding the company’s reputation.

Italian companies must familiarize themselves with various legal aspects, including company formation procedures, tax regulations, employment laws, and industry-specific rules. In this pursuit, we will explore the critical legal and regulatory facets that every Italian business must navigate, offering a simplified guide to ensure compliance and foster a thriving entrepreneurial journey amidst the captivating allure of Italy.

Different Legal Structures in Italy

The following are the different legal structures in Italy:

Sole Proprietorships

- Sole Trader (Ditta Individuale)

- Freelancer (Libero Professionista)

Partnerships

- General or Unlimited Partnership (SNC)

- Limited Partnership (SAS)

Corporations

- Limited Liability Company (SRL)

- Simplified Limited Liability Company (SRLS)

- Public Limited Company (SpA)

- Cooperative Society (Societa Cooperativa)

Limited Liability Companies (SRL) and Public Limited Companies (SpA) are Italy’s most common legal structures.

Starting a Company

Limited Liability Company (SRL) and Public Limited Company (SpA) are companies that offer limited liability protection. To set up a Limited Liability Company (SRL), you must prepare a Deed of Incorporation, including a Certificate of Incorporation and bylaws. Here’s what you need to provide in the Deed:

- Company name and address

- Purpose of the company

- Corporate capital (money invested in the company)

- Names of those authorized to represent the company and those responsible for auditing it

- The costs incurred for the incorporation process

The minimum required capital for a Limited Liability Company (SRL) is 10,000 Euros, while for a Public Limited Company (SpA), it is 120,000 Euros. Before finalizing the Deed of Incorporation, at least 25% of the subscribed capital must be deposited in an Italian bank. If there’s only one shareholder, they have to pay the entire capital during the incorporation. The bank will then issue a deposit certificate that needs to be included with the Deed.

A notary will handle registering the company with the Register of Companies. They’ll submit the incorporation deed to complete the registration. Once registered, the company will have legal status. After this, each director, or the sole director, should sign a form the Chamber of Commerce provided.

Corporate Governance

Corporate governance in Italy can be understood in three different ways, depending on the type of company, either Srl or SpA:

| Corporate Governance in Italy | Type of Company | Structure | Description |

| Traditional Structure | Srl or SpA | Managing Body | – Sole Director or |

| – Board of Directors | |||

| Board of Statutory Auditors | – Responsible for oversight | ||

| Dualistic Structure | Srl or SpA | Managing Board | – Elected and supervised by a separate Supervisory Board |

| Monistic Structure | Srl or SpA | Board of Directors | – Responsible for management |

| Internal Committee | – Established to control the management |

For companies registered as Public Limited Companies (SpA):

For SpA companies, it’s required to have a Board of Statutory Auditors. This group ensures that the company follows the law and maintains proper control. The board can have 3 or 5 members, and if any permanent member leaves, they can have substitutes. At least one member and substitute must be a certified public accountant, while the others can be accountants, lawyers, business or labor consultants.

For companies registered as Limited Liability Company (SRL):

For Srl companies, they usually have a Sole Director in charge of management, but they can also opt for a Board of Directors. Additionally, they have the choice of having a Board of Statutory Auditors, a single statutory auditor, or an outside certified public accountant and auditing firm to ensure proper control.

Minimum Capital Requirements

You need at least EUR 50,000 (or the equivalent in your currency) for SPA companies.

For SRL companies, the minimum required capital is EUR 10,000. However, you can establish an SRLS with as little as EUR 1 to EUR 9,999.

Requirements for Shareholder Meetings in Italy

For companies registered as Limited Liability Companies (SRL):

The company’s articles of association may allow decisions to be made through written consultation or consent by the quota-holders.

- If the articles of association don’t provide for this, certain decisions must be made through a quota holder’s meeting. These decisions include:

- amendments to the articles of association,

- substantial changes to the corporate purpose or shareholders’ rights

- capital decrease due to losses etc

- At the very least, quota-holders must approve the company’s financial statements annually.

For companies registered as Public Limited Companies (SpA):

- A shareholder’s meeting must be held at least once a year to approve the company’s Financial Statements.

- During a meeting, decisions must be made rather than adopting written resolutions.

Financial Reporting

Suppose you are an entrepreneur or a company in Italy. In that case, you must keep accounting records, except if you fall under the category described in Article 2083 of the Italian Civil Code or are a small-sized company (SS) without commercial activities.

The accounting records you must keep include the following:

- Original business correspondence like letters, invoices, faxes, and telegrams.

- A “Journal” to record daily company operations.

- A “Book of Inventories” that tracks the company’s economic performance.

Depending on the size, structure, and activities of your company, you might also need to keep additional accounting records, such as:

- Ledgers.

- A Warehouse book to record incoming and outgoing goods.

- Cash register records.

- Other books and records

In Italy, companies have to submit specific documents as part of their financial statements. These include:

- Balance sheet,

- A profit and loss statement,

- Notes to the accounts,

- And an annual report.

Smaller companies are exempt from providing annual reports if they meet specific criteria for two consecutive financial years. Instead, they can use shorter balance sheets per IAS/IFRS accounting principles.

Publication Requirements

In order to meet the rules for publishing, companies have to submit their yearly report, audit report, financial statements, and minutes of the AGM (which stands for Assemblea dei soci) to the company register within 30 days after the AGM.

Companies with unlimited liability (like SNC and SAS) don’t have to publish their accounts, but they still need to make a balance sheet and a profit and loss account. On the other hand, companies listed on the stock exchange must prepare financial statements every quarter.

Smaller companies have the choice to create shorter financial statements to make the reporting process simpler.

Audit of Annual Financial Statements

The purpose of a statutory audit is to check and approve the financial statements as required by law. An auditor reviews the accuracy and truthfulness of the financial statements based on the Italian Accounting Standards (OIC) and legal norms. Our audit follows the International Standards on Auditing (ISA) adapted for Italy.

Companies rely on auditors to provide an unbiased and objective opinion on financial statements. To ensure independence, auditors are kept from the company they are auditing. If any doubts arise about auditors’ independence, they cannot perform the audit.

Not all Italian corporations need a statutory audit. Only companies meeting specific criteria are subject to it. If, for two consecutive years, a company exceeds any of the following thresholds, it must appoint a supervisory body or an auditor:

- Balance sheet total: 4 million euros

- Revenues from sales and services: 4 million euros

- The average number of employees per year: 20

The shareholders’ meeting appoints an auditor for three years and sets their annual fee. After this term, the shareholders can reappoint the same auditor for another three years.

Upon completion of the audit of the annual accounts, auditors issue an audit opinion per the International Standards on Auditing (ISA Italia).

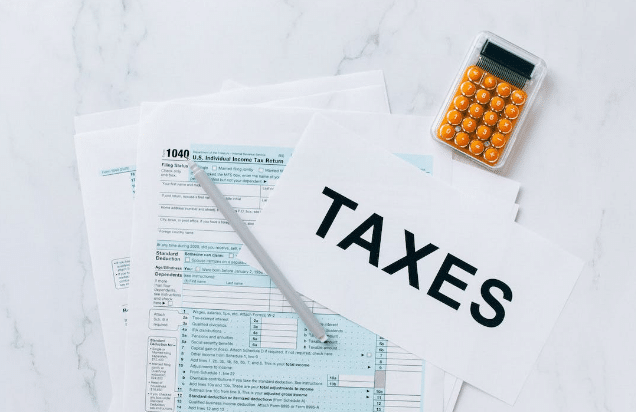

Taxes

| Tax Type | Tax Rate |

| VAT | 22% |

| Corporate Income Tax | 24% (income tax) |

| 3.9% (regional production tax) | |

| Employer Social Security | 29-32% |

| Employee Social Security | 10% |

| Capital Gains and Withholding | 26% (yields on loans and securities) |

The Italian Revenue Agency, also known as Agenzia della Entrate, handles taxes in Italy. It’s part of the Ministry of Economy and Finance and has offices at local, regional, and national levels. The Italian tax year starts on January 1st and ends on December 31st.

If a company conducts business activities in Italy, it must pay taxes. As long as a company has its management base or primary business operations in Italy, it will be subject to taxation. Companies are responsible for paying value-added, corporate income, and other taxes if they have been operating in Italy for at least 183 consecutive days. In this case, the company is considered a permanent establishment in Italy.

Annual Tax Return

Every year, limited liability companies must submit their tax return within 11 months after the end of the relevant tax period, which usually aligns with their balance sheet date.

Tax payments are split into two parts, payable during the tax year. The final balance is due at the same time as the first payment for the following year, which is on the 30th day of the sixth month after the end of the relevant tax period. There’s an option to postpone the payment to the 30th day of the seventh month but with a 0.4% interest charge.