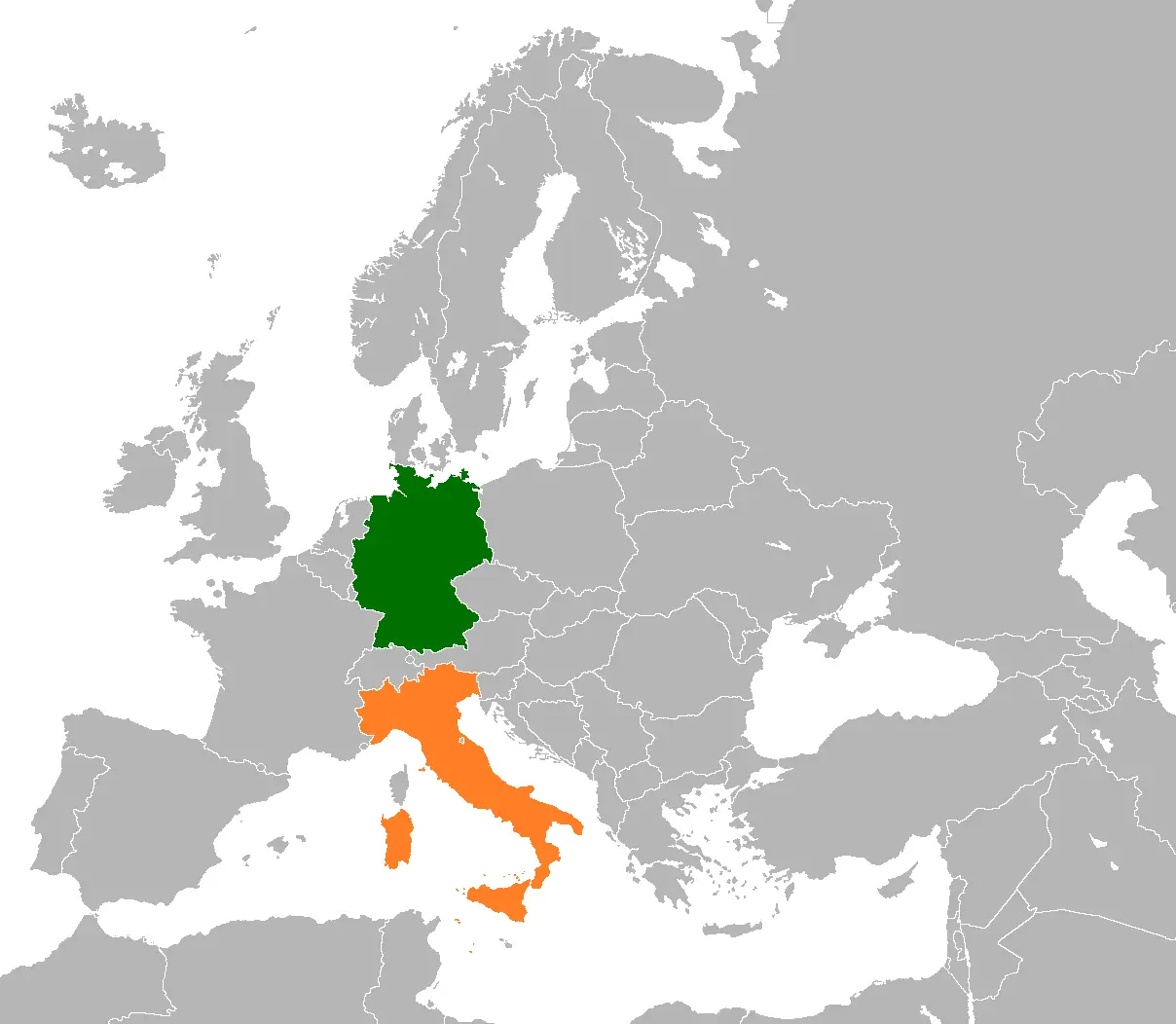

Two of the top locations to start or expand a business are Italy and Germany. Let’s compare the process of setting up a business in both countries.

Germany is one of the most prosperous countries in the world. The economy attracts millions of foreigners from all over the world and it is the second largest trader in terms of imports and exports, making it an obvious choice of country for foreign investors.

Italy has slowly been making a name for itself as a land of opportunity for business investors. It is succeeding in its endeavours by welcoming foreign investment and is now reaping the benefits.

Types of Company Formation

Germany offers four main choices of company type, namely: Limited Liability Corporation (GmbH), Stock Corporation (AG), Partnerships and Sole Proprietor.

Italy offers three main types of company corporation: Limited Liability (SL), Joint Stock Company (SpA), and Branches.

How complicated is the formation process in Germany and Italy?

Setting up in Italy is a little more complicated than other European companies. The following steps must be achieved: Obtain an Italian tax code and identity document; Open a local bank account; Arrange articles of association and memorandum of association; Register for VAT; File with the Registrar of Companies, and Secure approval by local tribunal.

In Germany foreign companies who are still deciding on committing to a brand new company can set up a branch by registering with the commercial register and trade office. This means though that the main company bears all responsibility for the branch regarding its tax and legal matters.

Availability of employees

Recruiting staff in Germany is easy, what with its abundance of skilled and highly qualified workers in most industrial sectors and a ready supply, particularly in the east and the Ruhr area where unemployment is high.

In Italy it is a little easier to recruit staff in the south of the country as opposed to the wealthier north, and the calibre of workers is generally high.

Regulatory Situation

All companies in Germany have to comply with detailed requirements set by the authorities. Government bodies oversee the banks while associations regulate the members of most other industries.

In Italy the regulatory laws are a lot more relaxed than they used to be. There are a number of double taxation treaties and capital and dividends that can be repatriated in line with EU rules. Foreign ownership is allowed in all industries except for the area of defence.

Financial Incentives

There is a wide range of incentive programmes on offer in Germany, dependent upon location and nature of the intended company. These include loans and grants. Some areas even offer as much as 50% investment grants to SMEs. Beneficial tax rates can also be offered as local government incentives but not usually in the big cities.

In Italy there are incentives on offer in areas of high unemployment with local tax breaks for ten years. There are also up to 50% research and development grants available and there are low interest loans for encouraging Italian exports.

Contact us about Italy and Germany companies formation

OpenAEuropeanCompany.com is always on hand to guide you through all of the stages of forming a new German or Italian enterprise or expanding an existing company, and we also provide document services across Europe – we can act as your notary for all of the necessary procedures to get you up and running in Germany and Italy. Please don’t hesitate to call us on +44 (0) 20 8421 7470 or contact us via the website for help and advice.