This is an idea for two or more individuals starting a business together.

Types:

In a GP, all partners share responsibilities and liabilities. In an LP, at least one general partner has unlimited liability, while limited partners’ liability is capped at their investment.

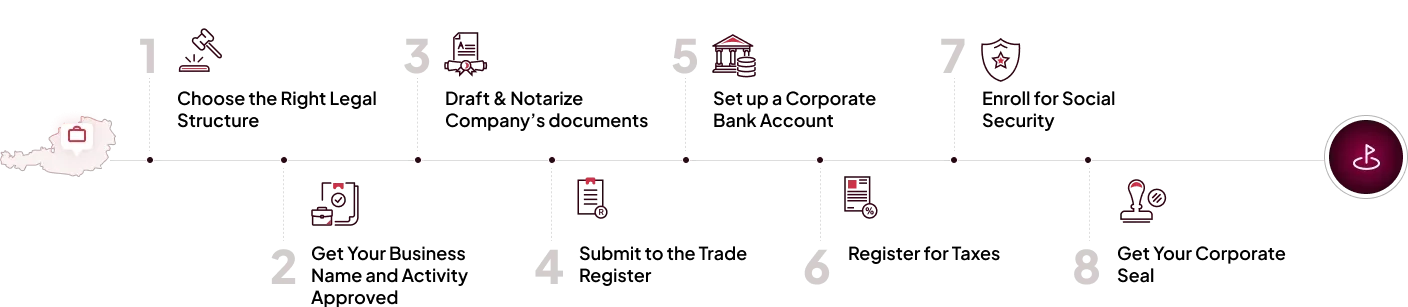

Register your company in USA in 8 easy steps:

Book a free consultation with our experts to get complete guidance every step of the way.