Register your company in South Africa with ease. We offer end-to-end support including legal setup, tax registration, and local compliance for foreign investors.

A Private Company, or Proprietary Limited (Pty) Ltd, is the most widely used entity in South Africa. It is ideal for small to medium-sized businesses and can be owned by individuals or other companies, both local and foreign. This structure offers limited liability protection and is governed by the Companies Act of 2008.

Key Features:

A Public Company can offer shares to the public and is suitable for larger businesses aiming to list on the Johannesburg Stock Exchange (JSE) or raise significant funding. It requires at least three directors and must appoint an auditor.

Key Features:

An External Company is a branch of a foreign entity operating in South Africa. It is not a separate legal entity but must register with the CIPC if it conducts business or has a physical presence in South Africa.

Key Features:

This structure is the simplest form of business and is operated by a single individual. There is no legal separation between the owner and the business.

Key Features:

A partnership is formed between two or more people who share profits, responsibilities, and liabilities. While it doesn’t have separate legal personality, it is often used for professional practices like law or accounting firms.

Key Features:

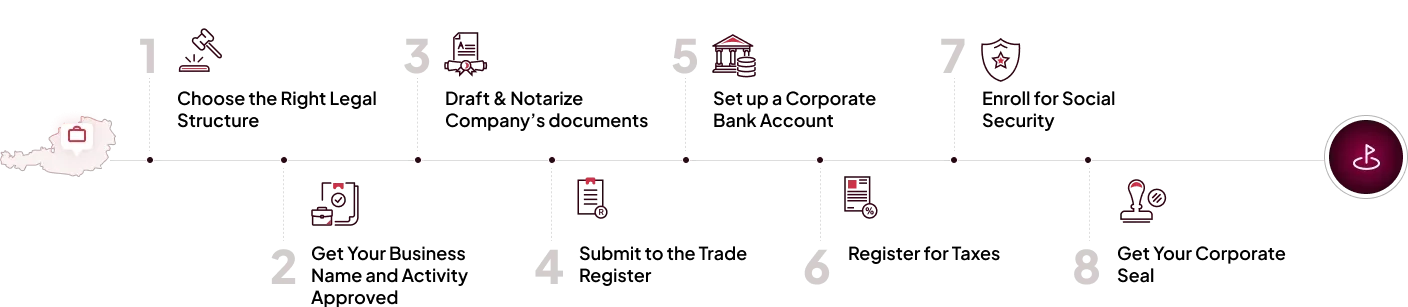

Register your company in South Africa in 8 easy steps:

Take the first step into one of Africa’s most dynamic markets. Whether starting fresh or expanding globally, we make South African company formation smooth, compliant, and fully remote.

Book a free consultation with our experts to get complete guidance every step of the way.

Company registration in South Africa typically takes 3 to 7 working days, depending on the type of entity and the accuracy of submitted documentation. Delays may occur if additional approvals or name reservations are required.

Yes, foreign nationals can fully own and register a company in South Africa. There is no requirement for a local shareholder, although having a local registered address and tax representative is mandatory.

The most common business structures include:

Generally, you’ll need:

Yes, to conduct business locally, your company must open a South African bank account. Most banks require the director(s) to be physically present for account setup, but we offer guidance and remote solutions through our local partners where possible.

Open A European Company.com is a trading name of Universal Company Incorporations Ltd. Universal Company Incorporations Ltd is a company registered in England and Wales with company number 08455371

+44 (0) 20 8421 7470

9:00 am-5:00 pm

Profile West Suite 2, Floor 1, Great West Road, Brentford, TW8 9ES

The information and any commentary on the law contained on this website is provided for information and guidance purposes only. Every reasonable effort is made to make the information and commentary accurate and up to date, but no responsibility for its accuracy and correctness, or for any consequences of relying upon it is assumed by Open A European Company, its directors , employees or associated websites.

The information and commentary on Open A European Company’s site does not, and is not intended to amount to legal advice to any third party on a specific case or matter. You are strongly recommended to obtain specific, direct legal advice from professional advisers whether these be your own advisers or those that appear on the OpenAeuropeancompany.com site. You should consider taking advice both in the country in which you are domiciled and in the country in which you are seeking to open a company. and not to rely on the information or comments on this site.

©2025 Open a European Company