Launch your business in Hong Kong with ease. We offer fast, remote company formation with full legal compliance, banking, and support.

This is the most preferred business structure in Hong Kong, especially for foreign investors and SMEs.

Suitable for small, one-person businesses with minimal regulatory needs.

Allows two or more individuals or companies to jointly operate a business.

This is an extension of a foreign parent company operating in Hong Kong.

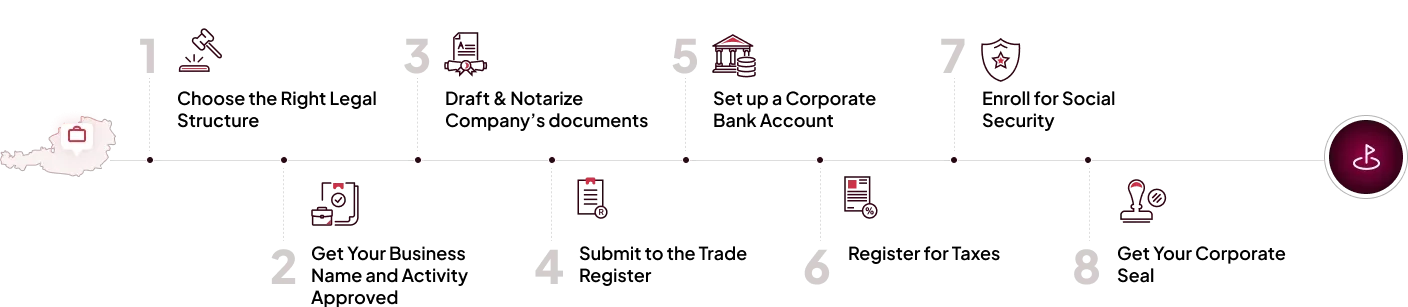

Register your company in Hong Kong in 8 easy steps:

We simplify the process for you by offering expert guidance and comprehensive support. Focus on expanding your business while we handle the complexities.

Book a free consultation with our experts to get complete guidance every step of the way.

Yes, you can register your company remotely using a service provider.

The tax rate is 8.25% on the first HKD 2 million and 16.5% thereafter.

Usually between 1 to 3 business days if documentation is complete.

No, foreign nationals can be directors. A local company secretary is required.

Some banks allow remote account opening, though others may require in-person verification or a digital onboarding partner.

Open A European Company.com is a trading name of Universal Company Incorporations Ltd. Universal Company Incorporations Ltd is a company registered in England and Wales with company number 08455371

+44 (0) 20 8421 7470

9:00 am-5:00 pm

Profile West Suite 2, Floor 1, Great West Road, Brentford, TW8 9ES

The information and any commentary on the law contained on this website is provided for information and guidance purposes only. Every reasonable effort is made to make the information and commentary accurate and up to date, but no responsibility for its accuracy and correctness, or for any consequences of relying upon it is assumed by Open A European Company, its directors , employees or associated websites.

The information and commentary on Open A European Company’s site does not, and is not intended to amount to legal advice to any third party on a specific case or matter. You are strongly recommended to obtain specific, direct legal advice from professional advisers whether these be your own advisers or those that appear on the OpenAeuropeancompany.com site. You should consider taking advice both in the country in which you are domiciled and in the country in which you are seeking to open a company. and not to rely on the information or comments on this site.

©2025 Open a European Company