Set up your UAE company quickly with expert support. 100% ownership in Free Zones, tax benefits, and full compliance all done remotely.

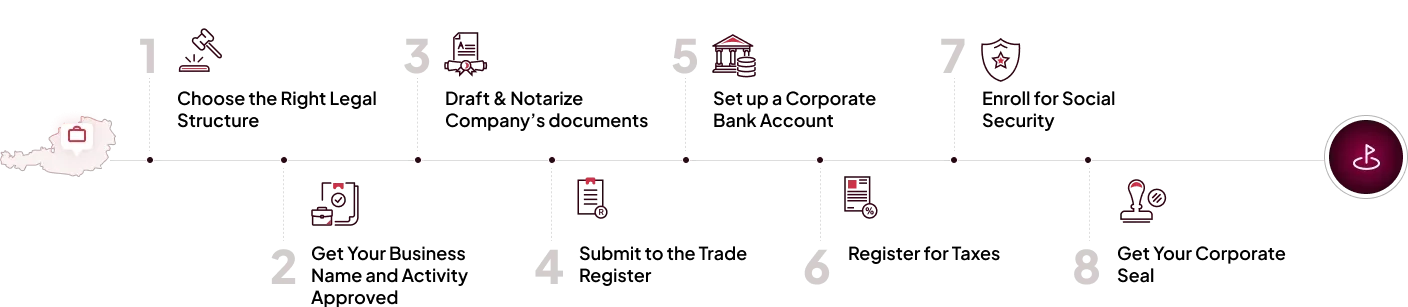

Register your company in UAE in 8 easy steps:

Take the first step toward unlocking growth in the Middle East’s most dynamic economy. We ensure your UAE company setup is fast, compliant, and fully remote.

Book a free consultation with our experts to get complete guidance every step of the way.

No, you can register a Free Zone or Offshore company 100% remotely. Mainland setups may require some in-person steps.

It typically takes 3 to 10 business days, depending on the jurisdiction and documentation.

Yes. Free Zone and Mainland company owners are eligible to apply for investor or partner visas.

Basic requirements include a passport copy, passport-sized photo, and proof of address. Additional documents depend on the license type.

From 2023, a 9% corporate tax applies only on profits above AED 375,000. Free Zones may still benefit from 0% tax if they meet qualifying criteria.

Open A European Company.com is a trading name of Universal Company Incorporations Ltd. Universal Company Incorporations Ltd is a company registered in England and Wales with company number 08455371

+44 (0) 20 8421 7470

9:00 am-5:00 pm

Profile West Suite 2, Floor 1, Great West Road, Brentford, TW8 9ES

The information and any commentary on the law contained on this website is provided for information and guidance purposes only. Every reasonable effort is made to make the information and commentary accurate and up to date, but no responsibility for its accuracy and correctness, or for any consequences of relying upon it is assumed by Open A European Company, its directors , employees or associated websites.

The information and commentary on Open A European Company’s site does not, and is not intended to amount to legal advice to any third party on a specific case or matter. You are strongly recommended to obtain specific, direct legal advice from professional advisers whether these be your own advisers or those that appear on the OpenAeuropeancompany.com site. You should consider taking advice both in the country in which you are domiciled and in the country in which you are seeking to open a company. and not to rely on the information or comments on this site.

©2025 Open a European Company