Set up your company in Norway easily with the help of our experts, who offer a seamless registration process from start to finish.

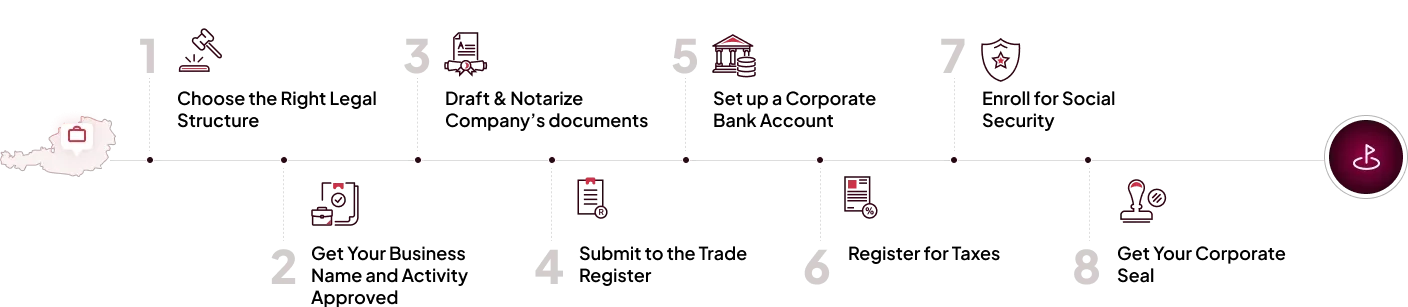

Register your company in Norway in 8 easy steps

Book a free consultation with our experts to get complete guidance every step of the way.

Yes, both EU and non-EU nationals can start a business in Norway. You’ll need a Norwegian identification number and a local registered address. Our team can help you navigate these requirements with or without physical presence.

The most popular structure is the Aksjeselskap (AS) a private limited company. It offers limited liability and is suitable for small to medium-sized enterprises. A minimum share capital of NOK 30,000 is required.

No, foreign residents can be both shareholders and directors of a Norwegian AS company. However, at least one board member or alternate must reside in Norway or the EEA. We offer solutions to meet this requirement.

The process typically takes 5 to 10 working days, depending on how quickly all documents are prepared and submitted. We offer end-to-end support to ensure a seamless registration process.

Norwegian companies are subject to corporate tax (22%), VAT (25%), and employer social security contributions. Our accountancy services help ensure full compliance with all local tax regulations.