Take the first step towards your French business success today. Allow us to assist you in laying a foundation for growth and success.

An SA (“société anonyme”) requires at least 7 shareholders to be incorporated.

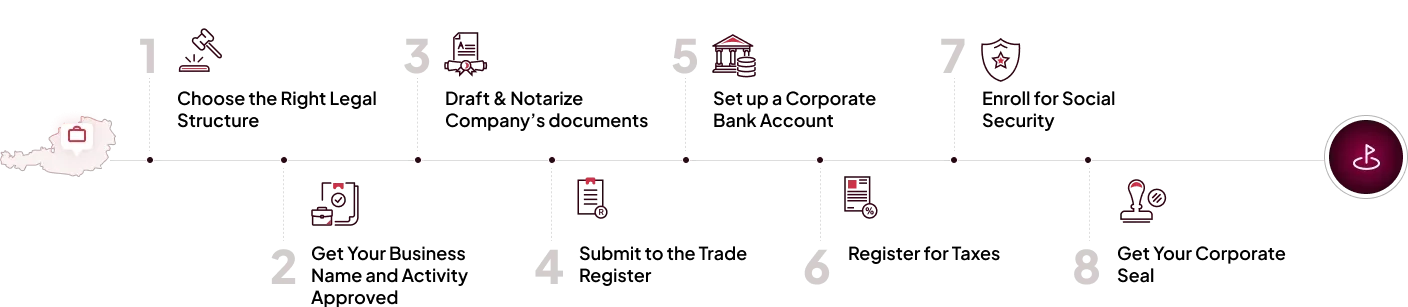

Register your company in France in 8 easy steps

Book a free consultation with our experts to get complete guidance every step of the way.

The time frame for establishing a business in France varies depending on factors such as the chosen business structure, the complexity of the registration process, and the completion of necessary paperwork.