We provide a comprehensive solution that allows you to concentrate on your business goals.

This is best suited for start-ups, SMES, and foreign entrepreneurs.

It is best for larger businesses, corporations, and companies that are looking for investors:

It is suitable for small businesses with more than 2partners:

This is best for all the freelancers and one-person business:

This is ideal for companies wanting a presence in Belgium without full incorporation:

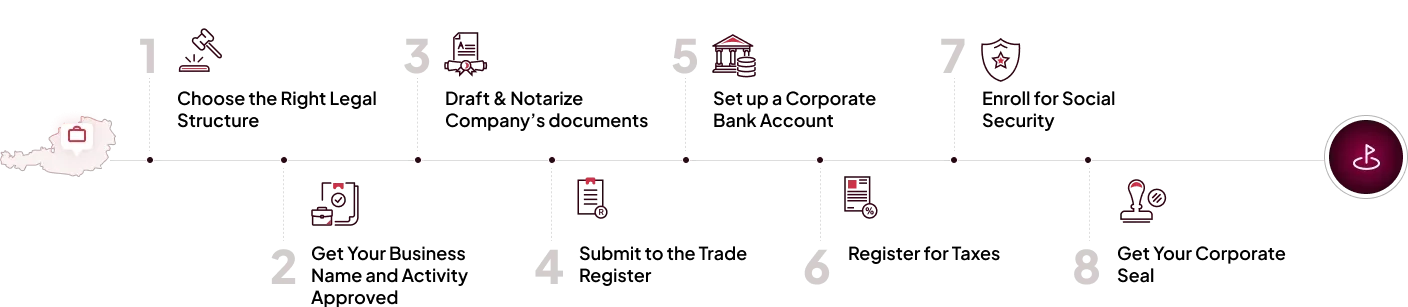

Register your company in Belgium in 8 easy steps

Book a free consultation with our experts to get complete guidance every step of the way.

– Choosing a suitable Business Structure

– Business Name

– Drawing up the company documents

– Registration with the Belgian Trade Register

– Obtaining VAT number and other necessary permits and licenses

The company’s bank account is crucial for future financial transactions and depositing share capital. In Belgium, banks typically require incorporation documents and founder data to open a corporate bank account.